If you are a foreigner planning to make a move or just got landed in Japan for work. Well, great this could helpful guide for you to understand taxes (Zeikin). The Japanese tax system is composed of national and local taxes.

For gaijins (foreigners), Japanese income tax (shotokuzei) is determined by status of residence. Foreigners who have lived in Japan for less then one year are considered non-residents. They are required to pay income tax only on income generated in Japan.

Gaijins who have lived in Japan of more than one year are differently categorise into those who have stayed in Japan less than five years and those who have stayed longer. Both these groups are considered ¨residents¨ under Japanese tax law and are taxed on all income generated in or sent to Japan.

Income Tax

The Japanese tax calendar year is from January 1 to December 31. Income tax returns must be filed between February 16 and March 15. Foreigners leaving Japan before the tax deadline must file their returns before they go out the country, or designate a proxy to file a return for them. Income tax is only required on income over 380,000 yen.

A tax deductions could be possible when provision for medical costs, spouses and property losses. Each of these cases, documentation is required. Non-residents are not eligible for most deductions.

Non-salaried workers must file their own tax returns and pay to the local tax office themselves. Salaried employees, on the other hand, have their tax contributions withheld by their employers.

Residential tax

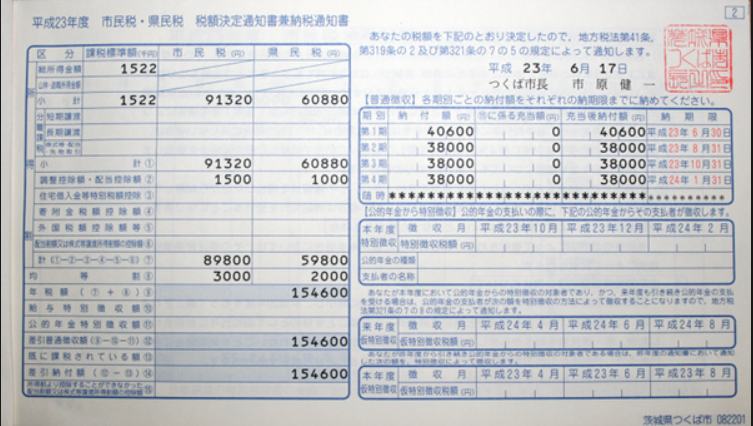

Residential tax (juminzei) is a local tax, based off the previous year´s income. This must be paid if an individual has lived in Japan for more than a year. Residents pay this tax to the ward that they lived in on January 1.

As with income tax, non-salary workers pay residential tax themselves, making four payments throughout the year (in June, August, October and January). Salaried employees have their residential taxes withheld throughout the year. But there are cases where employers don’t withheld residential taxes and individual must settle it by themselves.

How to make a payment

Upon receiving the slip from your employer. You can pay through the bank, convenient store or municipality/ward office. The recommended and easiest way is to go to the convenient store.

The slip looks something like this:

I hope this article helps you a bit about these two taxes in Japan.